Provide a broad perspective on the return of industrial and commercial productivity in the U.K. and determine how sustainable the new trend may be. A comparison of the U.K. and US to highlight the effects of different country-specific factors, with a focus on providing information useful to investors and senior managers.

Productivity gains may be measured in terms of relative improvements in factor, efficiency and innovation driven indicators (Schwab 2017). The United Kingdom (UK) is an innovation-driven economy and can be stimulated with the progress of systems that tend to encourage business innovation and sophistication. Efficiency gains may be achieved through investment in education and training, goods and labour markets, and the development of the financial markets (BIS 2013; Schwab 2017). This paper examines the trends and sustainability of industrial and commercial productivity in the UK and its comparison with US with reference to a suitable macro-environment, provision of healthcare, primary education and the development of infrastructure and institutions (Blaug 2009; Brighton et al. 2016).

The Global Competitiveness Index (GCI) can be used to examine the factors that drive long-term economic growth and prosperity in a nation. This index uses indicators such as institutions, policies and factors that determine productivity (Schwab 2017). The UK was ranked eighth in terms of competitiveness while the US ranked second with scores reported at 5.51 and 5.85 on a scale of 7, respectively (Schwab 2017). The UK reported a slight improvement in the competitiveness score from 5.49 last year; however, this improvement was negligible when compared to 0.15 for the US (Schwab 2017). The UK became less competitive with a decline in the overall rank when compared to an improvement in the rank of US. While the UK registered a small increase of 0.1 in its GCI score over the past 5 years, the US reported an improvement of 0.4 (Schwab 2017). Schwab (2017) argued that recent growth in productivity is rather cyclical and encouraged by low interest rates as opposed to fundamental drivers that aid structural growth; thereby, it is not expected to return to historic levels (Salazar-Xirinachs et al. 2014). The literature emphasises the need to unleash productivity in the context of the next industrial revolution and to fundamentally change the limits on productivity (Blaug 2009; Brighton et al. 2016). Therefore, it can be argued that such technological disruption is necessary to sustain industrial and commercial productivity.

Schwab (2017) reiterated that recent productivity gains in the developed markets are not sustainable due to the new vulnerabilities evident in the financial sector. For example, the indicators of bank soundness have failed to recover to the pre-crisis levels a decade after the global financial crisis (GFC) of 2008 (Schwab 2017). New sources of vulnerability include a growth of the unregulated capital markets and a decline in the range of measures available to the government to manage a crisis (Schwab 2017). These productivity gains may be less sustainable due to an exponential increase in government debt for both the UK and the US (Refer to Appendix A).

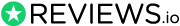

The UK ranked higher in terms of technological readiness when compared to the US; however, the US demonstrated considerable improvement in this regard during the recent years. Moreover, the US received the top rank for productivity gains through innovation while the UK was ranked below Germany and Japan, respectively (Schwab 2017). Schwab (2017) argued that the industrial and commercial productivity of UK is expected to deteriorate after the outcome of Brexit negotiations. Furthermore, Schwab (2017) identified factors that affected business productivity in the UK including excessive tax regulations, policy instability, government bureaucracy, lack of education and inadequate infrastructure (Refer to Appendix B). The key pillars for sustainable growth in the UK were identified to include investments in research and innovation, skills, infrastructure, small businesses, procurement, inward investment in trade, affordable and clean energy, competitive advantage, inclusive growth and institutional development (Samans et al. 2017; Syverson 2011). Likewise, avenues for sustaining industrial and commercial productivity include an improvement in the macroeconomic environment, long-term investments in education, training, healthcare and financial market development (Demeter et al. 2011).

If you need assistance with writing your essay, our professional Essay Writing Service is here to help!

Find out moreYet, the US exhibited higher macroeconomic uncertainty when compared to the UK which emphasised the need for significant improvement in healthcare, primary education and the development of institutions (Demeter et al. 2011). Problematic factors for US businesses include significant challenges such as restrictive labour regulations, corruption and inadequate infrastructure. The fact that the second most competitive economy struggled with corruption, government inefficiencies, lack of access to healthcare and quality education added concerns about sustainability of recent improvements in productivity (UN 2016). Consequently, concerns regarding the business impacts of bribery, organised crime, budget deficits and national savings highlight challenges for sustaining productivity over the long-term (UN 2016).

Foda (2017) argued that productivity is key to future growth; however, weak productivity growth during the recent years resulted in a relatively low growth in the gross domestic product (GDP). The advanced economies registered a GDP growth of 0.3 percent from 2008 to 2015 when compared to 2 percent during the period from 1990 to 2007. Foda (2017) emphasised that a slowdown in labour productivity was associated with a low growth in total factor productivity (TFP); however, capital deepening exerted a more pronounced influence during the recent years. Foda (2017) determined that productivity gains in the UK and US were temporary and such trends pre-dated the GFC. Additionally, this decline spanned across both the manufacturing and services industries (Baily & Bosworth 2014; Rodrik 2013). Thereby, a major technological disruption is needed to generate sustainable productivity growth in industrial and commercial productivity (Refer to Appendix C).

Foda (2017) found that the labour productivity across the developed markets converged during 1950 and 1990; yet, productivity in the UK remained relatively low when compared with the US (Refer to Appendix D). The results indicated that relative labour productivity increased during 1950 to 2007 while declined in comparison to the US from 2008 to 2015. Despite reporting higher relative productivity rates, the US productivity continued to decline in absolute terms from 2.5 to 1 percent between the periods ranging from 1996-2004 and 2005-2015. About 60 percent of the growth in labour productivity in the US was associated with improvements in terms of TFP from 2005-2015 (Foda 2017). Foda (2016) determined that the prevalence of a slowdown in productivity throughout the global markets and across different sectors including manufacturing and services sectors. Technological advances during the last decade were insufficient to deliver a substantial improvement in commercial and industrial productivity (Foda 2016). Arguably, there is potential for sustainable improvements in productivity with technological disruptions; however, many of these innovations have not yet materialised (UN 2013). Therefore, recent productivity gains are less likely to be sustainable for the UK and the US.

WB (2018) emphasized that there were a variety of downside risks associated with the more recent upturn in the global markets. Though, the assessment fell short of identifying a disturbing trend in terms of a significant decline in the TFP during the recent decade (Foda 2016). The downside risks associated with the upturn were generally attributed to the need for improving structural policies in the UK and the US. The recent improvement in industrial and commercial productivity may be less sustainable if the decline in TFP is associated with factors including a slowdown in innovation, business dynamism, investment, barriers to innovation and a mismatch of skills (WEF 2014; WB 2018). For example, barriers to innovation include a misallocation of inputs due to regulatory distortions (Foda 2017; Foda 2016).

Free Undergraduate Lectures

Samans et al. (2017) emphasised that the US is a global innovation powerhouse with strong fundamentals for asset-building and entrepreneurship; these factors are indispensable for delivering long-term productivity (Parpala 2014). Efforts to deliver inclusive growth yielded mixed results with robust business creation and access to finance in the UK while at the same time productivity decelerated due to low social mobility, a workforce less prepared for the modern work environment and inadequate protections for the labour (Gorg et al. 2016; Samans et al. 2017). Recently, the UK government emphasised that productivity gains may be achieved with a reduction in the gap between the most and the least productive firms, sectors and people in the economy; however, an actionable plan to fill the gap was not presented (HM Government 2017).

Haldane et al. (2017) noted that much of the growth in UK’s living standards can be credited to productivity gains as opposed to capital deepening. Historical errors in productivity forecasts resulted in researchers to imply the possibility of an era of secular stagnation; however, this may be countered with secular innovation. Such a period of sustainable growth in productivity requires a variety of influences including artificial intelligence, robots, big data, the internet of things and more (Haldane et al. 2017; McGowan et al. 2016; Purdy & Daugherty 2016). Haldane et al. (2017) validated the assertion that policy measures aimed at reducing the dispersion of productivity at the midst of the business community may result in a more sustainable framework. Bughin et al. (2017) estimated that automation could deliver sustainable annual productivity gains in the range of 0.8 and 1.4 percent. It can be argued that automation can enable businesses to accelerate productivity with an improvement in throughput, quality enhancements, decreased downtime and enhanced competitive advantage with robust macroeconomic outcomes for the UK (Bughin et al. 2017).

Arguably, the UK and US may experience co-existence between secular innovation and stagnation at least over the medium-term. Thereby, leading firms may continue to provide significant productivity growth while laggards may stagnate with the advent of the next industrial revolution (Haldane et al. 2017). Bughin et al. (2017) emphasised that machines may usher a new age of automation by outperforming humans in terms of cognitive ability. However, recent gains in industrial and commercial productivity in the UK are not explained by policy or technology related improvements. The pace and extent of adoption of existing technology is dependent on factors including technical feasibility, cost of developing and deploying solutions, labour market dynamics, economic benefits, and regulatory and social acceptance (Bughin et al. 2017). Likewise, policy makers in the UK have been unable to encourage adequate investment that is vital for the process of automation (Bughin et al. 2017). This may be associated with political and social pressures against the adoption of new technologies including the fear of losing employment. However, the aging demographics suggest that automation is needed to maintain and enhance the living standards in the economies in the UK and US. Therefore, such gains are not sustainable over the long-term without a technological change that leads to a paradigm shift.

UN (2016) stated that diversification into the manufacturing sector can provide rapid average growth rates, extended periods of growth and a reduction in volatility in the rate of growth. This assertion assumes that long-term and sustainable growth may be generated from investments in the manufacturing sector with significant scope for application of technology (Green et al. 2017). However, the services sector dominates the UK economy which implies a higher volatility and lower sustainability of productivity gains (Woodhouse 2010). In addition, the UN (2016) emphasised that a crucial component of any industrial revolution is a shift in the resources from labour to technology-intensive activities; thereby, the need to match skills with the pace of technical change is imperative for delivering sustained growth in productivity. However, Abdel-Wahab et al. (2008) did not find significant correlation between skill development and productivity in the construction industry. Bakhshi et al. (2017) challenged the culture of risk aversion that tends to hold back the adoption of technology in the UK; thereby, demonstrating structural productivity problems (Frey & Osborne 2013). There is a need to examine complex dependencies amongst job features to combine expert human judgement with machine learning with the objective to optimize the skill competencies needed to compete in the modern business environment (Bakhshi et al. 2017).

If you need assistance with writing your essay, our professional Essay Writing Service is here to help!

Find out moreTo conclude, business strategy and government policy needs to focus on investment in skills to adapt to the structural imbalances in the labour markets. Consequently, technological advancement should not be frowned upon when implementing policy; instead synergies between the machine and the humans should be fully explored to generate long-term productivity improvements in the UK and the US. Likewise, there is a need for businesses to demonstrate leadership and to generate shared and inclusive productivity gains; thereby, encouraging investment and inducing social change to ensure sustainable growth.

Bibliography

- Abdel-Wahab, M, Dainty, A, Ison, S, Bowen, P and Hazelhurst, G. (2008). Trends of skills and productivity in the UK construction industry. Engineering, Construction and Architectural Management, Vol. 15 (4), pp. 372-382.

- Baily, M and Bosworth, B. (2014). US manufacturing: Understanding its past and its potential future. Journal of Economic Perspectives, Vol. 28 (1), pp. 3-26.

- Bakhshi, H, Downing, J, Osborne, M and Schneider, P. (2017). The future of skills: Employment in 2030. London: Pearson and Nesta.

- Blaug, M. (2009). The economics of productivity. London: Edward-Elgar.

- Brighton, R, Gibbon, C and Brown, S. (2016). Understanding the future of productivity in the creative industries. London: SQW Limited.

- Bughin, J, Manyika, J and Woetzel, J. (2017). A future that works: Automation, employment and productivity. Brussels: McKinsey Global Institute.

- Business, Innovation and Skills. (BIS) (2013). International comparative performance of the UK research base: A report prepared by Elsevier for the UK’s Department of BIS. London: BIS.

- Demeter, K, Chikan, A and Matyusz, Z. (2011). Labour productivity change: Drivers, business impact and macroeconomics moderators. International Journal of Production Economics, Vol. 131 (1), pp. 215-223.

- Foda, K. (2017). What’s happening to productivity growth? Key macro trends and patterns. Washington D.C: Brookings Institution.

- Foda, K. (2016). The productivity slump: A summary of the evidence. Washington D.C: Brookings Institution.

- Frey, C and Osborne, M. (2013). The future of employment: How susceptible are jobs to computerisation? Oxford: University of Oxford.

- Gorg, H, Henze, P, Jienwatcharmongkhol, V, Kopasker, D, Molana, H, Montagna, C and Sjoholm, F. (2016). Firm size distribution and employment fluctuation: Theory and evidence. Stockholm: Research Institute of Industrial Economics.

- Green, A, Hogarth, T, Kispeter, E and Owen, D. (2016). The future of productivity in manufacturing: Strategic labour market intelligence report. London: SQW Limited.

- Haldane, A. (2017). Productivity puzzles. London: Bank of England.

- Her Majesty’s (HM) Government. (2017). Building our investment strategy. London: HM Government.

- McGowan, M, Andrews, D, Criscuolo, C and Nicoletti, G. (2016). The future of productivity. Paris: Organisation of Economic Co-operation and Development.

- Parpala, M. (2014). The U.S. semi-conductor industry: Growing our economy through innovation. Washington D.C: Semi-conductor Industry Association.

- Purdy, M and Daugherty, P. (2016). Why artificial intelligence is the future of growth? Dublin: Accenture.

- Rodrik, D. (2013). Unconditional convergence in manufacturing. The Quarterly Journal of Economics, Vol. 2013 (1), pp. 165-204.

- Salazar-Xirinachs, J, Nubler, I and Kozul-Wright, R. (2014). Transforming economies: Making industrial policy work for growth, jobs and development. Geneva: International Labour Office.

- Samans, R, Blanke, J, Hanouz, M and Corrigan, G. (2017). The inclusive growth and development report 2017. Geneva: World Economic Forum.

- Schwab, K. (2017). Insight report: The global competitiveness report 2017-2018. Geneva: World Economic Forum.

- Syverson, C. (2011). What determines productivity? Journal of Economic Literature, Vol. 49 (2), pp. 326-365.

- United Nations (UN). (2016). Industrial development report 2016: The role of technology and innovation in inclusive and sustainable industrial development. Vienna: United Nations Industrial Development Organisation.

- UN. (2013). World Economic and Social Survey 2013: Sustainable development challenges. New York: Department of Economic and Social Affairs.

- Woodhouse, P. (2010). Beyond industrial agriculture? Some questions about farm size, productivity and sustainability. Journal of Agrarian Change, Vol. 10 (3), pp. 437-453.

- World Bank (WB). (2018). Global economic prospects: Broad-based upturn, but for how long? Washington D.C: WB.

- World Economic Forum (WEF). (2014). Matching skills and labour market needs: Building social partnerships for better skills and better jobs. Davos: WEF.

![General government debt (% GDP) [2006 vs 2016]](images/business/general-government-debt.jpg)

General government debt (Schwab 2017)

Most problematic factors for doing business in UK (Schwab 2017)

![Trend of labour productivity growth in advanced economies [1971-2015]](images/business/productivity-growth-advanced-economies.jpg)

Trend of labour productivity growth in advanced economies (Foda 2017)

![Convergence and divergence in labour productivity [1950-1990] [1990-2015]](images/business/convergence-divergence-labour-productivity.jpg)

Convergence and divergence in labour productivity (US =1)

Cite This Work

To export a reference to this article please select a referencing style below: